The 2026 Gambling Tax Law: What +EV Bettors Need to Know

⚠️ DISCLAIMER: This article is for educational purposes only and is NOT tax or financial advice. Tax situations are highly individual and depend on many factors specific to your circumstances. Before making any decisions about your betting activity or tax strategy, please consult with a qualified accountant, tax professional, or CPA who can review your specific situation. The information here is general guidance to help you understand the basics - not a substitute for professional advice.

What's Happening?

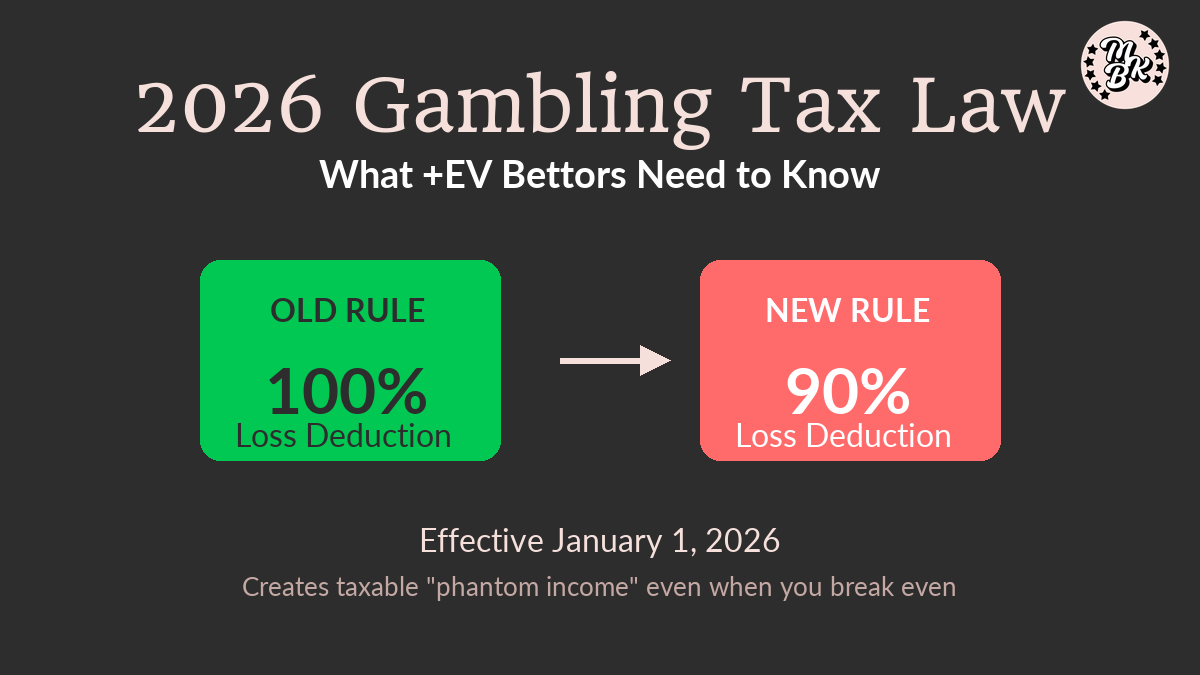

On July 4, 2025, President Trump signed the "One Big Beautiful Bill Act" (OBBBA) into law. Buried in this massive tax bill was a provision that changed how gambling losses are taxed - and it went into effect January 1, 2026.

The change: You can now only deduct 90% of your gambling losses against your winnings, instead of the previous 100%.

This might not sound like a big deal, but for active +EV bettors - especially high-volume bettors - it can create a significant tax liability even when you break even or barely profit.

Let me explain exactly what this means, who it affects, and what you can do about it.

How Gambling Taxes Work: The Basics

Before we dive into the new law, let's make sure everyone understands how gambling taxes work in the first place. If you've never thought about this before, here's what you need to know:

Key Terms You Need to Know

The IRS uses specific definitions for gambling income. Here's what each term means:

Handle = Your total amount wagered for the year. If you bet $100 per day for a year, your handle is ~$36,500.

Winnings = The profit from your winning bets (payout minus your original stake). This is the sum of all your individual winning bet profits - not your net profit for the year.

Losses = The stakes you lost on losing bets. The actual cash you wagered and didn't get back.

Net Profit = Winnings minus Losses. This is what you actually made (or lost) overall.

Important: The IRS requires you to report Winnings and Losses separately - you can't just report your net profit.

Example: Let's say you bet $100,000 total for the year and ended up 5% ROI ($5,000 profit). Your breakdown might look like:

Handle: $100,000

Winnings (profit from wins): ~$85,000

Losses (stakes lost): ~$80,000

Net Profit: $5,000

Notice that Winnings and Losses are both much larger than your net profit - and they're not directly tied to your handle. That's because you're adding up all the profits from winning bets and all the stakes from losing bets separately, and those totals depend on how your individual bets played out (win rate, odds, variance, etc.). Two bettors with the same $100K handle could have very different Winnings and Losses totals. We'll walk through real numbers from my betting history below.

All Gambling Winnings Are Taxable Income

When you win a bet, that profit is considered taxable income by the IRS. This is true whether:

You get a W-2G form from a sportsbook

You cash out from your accounts

You just have net winnings sitting in your betting apps

The IRS expects you to report ALL gambling winnings as income - even if the sportsbook doesn't send you a tax form.

Gambling Losses Can Offset Winnings (With Rules)

The good news: gambling losses can be used to reduce your taxable gambling income.

But there's a catch: You can ONLY deduct gambling losses if you itemize your deductions on your tax return.

If you take the standard deduction (which most Americans do), you cannot deduct gambling losses at all - your entire gambling winnings are taxed as income.

The Old Rule (Before 2026)

Previously: If you itemized, you could deduct gambling losses up to the amount of your gambling winnings.

Profit example:

You won $50,000 in gambling winnings for the year

You had $45,000 in gambling losses

You could deduct the full $45,000 in losses

You'd pay taxes on $5,000 of net gambling income

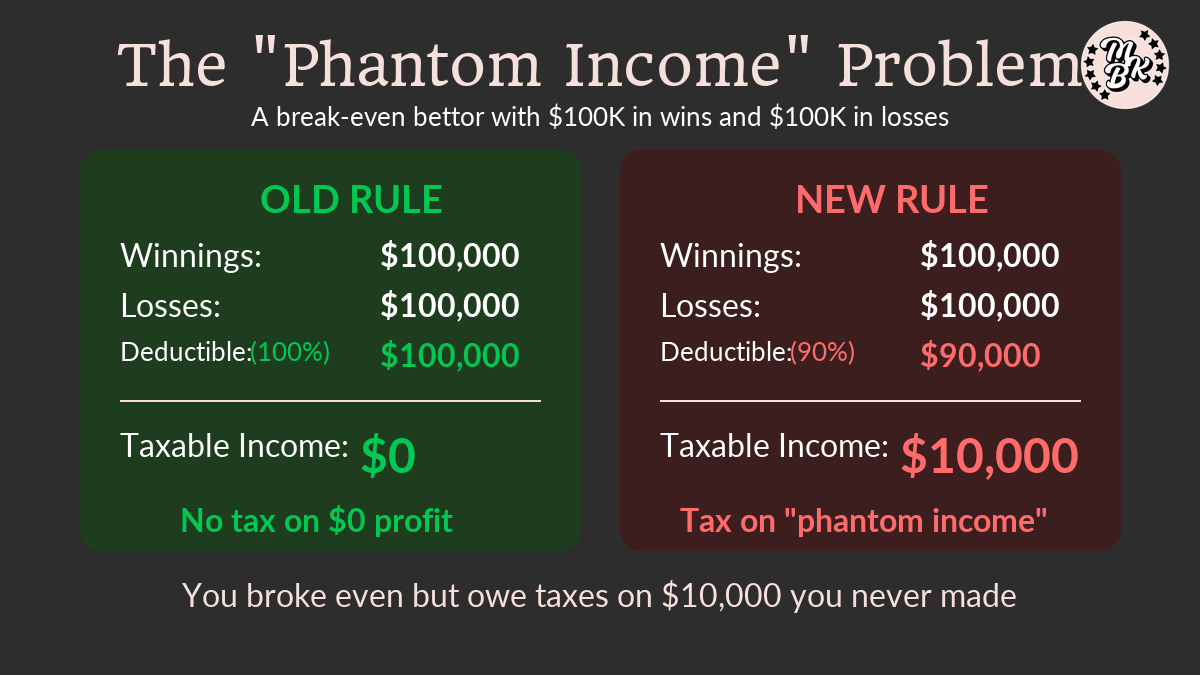

Break-even example:

You won $100,000 in winnings

You had $100,000 in losses

You could deduct the full $100,000

Net taxable gambling income: $0

The New Rule (2026 and Beyond)

Now: You can only deduct 90% of your gambling losses against winnings.

Same break-even example under the new rule:

You won $100,000 in winnings

You had $100,000 in losses

You can only deduct $90,000 (90% of $100,000)

Net taxable gambling income: $10,000

You broke even on your actual betting. But the IRS now taxes you as if you made $10,000.

This is called "phantom income" - you're being taxed on money you never actually made.

Wait - What Does "Itemize" Mean?

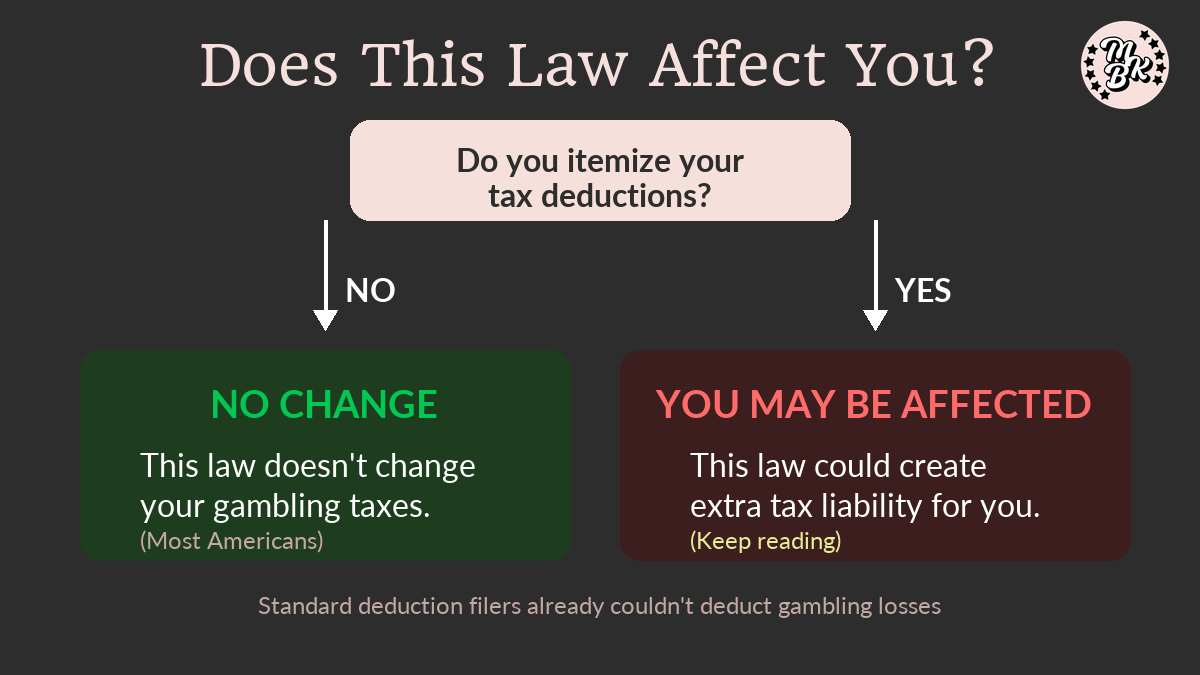

This is critical, because the new law only affects you if you itemize your deductions.

When you file your federal tax return, you have two choices for deductions:

Option 1: Standard Deduction

You take a flat deduction amount set by the IRS. For 2026:

Single filers: $15,000 (approximately)

Married filing jointly: $30,000 (approximately)

Most Americans take the standard deduction because it's simple and usually larger than their itemized deductions.

If you take the standard deduction, you CANNOT deduct gambling losses at all. Your full gambling winnings are taxed as income.

Option 2: Itemize Deductions

Instead of the flat standard deduction, you add up all your individual deductible expenses:

State and local taxes (SALT) - capped at $10,000

Mortgage interest

Charitable donations

Medical expenses (above 7.5% of income)

Gambling losses (up to winnings)

If these itemized deductions add up to MORE than the standard deduction, itemizing saves you money.

How to Know If You Itemize

You likely itemize if:

You own a home with a mortgage and pay significant interest

You live in a high-tax state (California, New York, New Jersey, etc.)

You make substantial charitable donations

You have significant medical expenses

You own rental/investment real estate with deductible expenses

You have significant investment interest expenses (margin interest, investment loans)

Your total deductions exceed the standard deduction amount (~$16,100 single / ~$32,200 married in 2026)

You likely take the standard deduction if:

You rent instead of own

You live in a low/no income tax state (Texas, Florida, Nevada, etc.)

You don't have major deductible expenses

You've never thought about itemizing before

A note about self-employed/business owners: If you're self-employed or run a business, your business expenses (Schedule C) are deducted separately from your personal itemized deductions. You can take the standard deduction AND still deduct business expenses. Being self-employed doesn't automatically mean you itemize - it depends on your personal deductible expenses (mortgage, state taxes, etc.), not your business expenses.

Quick check: Look at your most recent tax return (or ask your accountant). Line 12 of Form 1040 shows your deduction. If it matches the standard deduction amounts, you're not itemizing.

So... Does This Affect Me?

Here's the reality check:

If You DON'T Itemize (Most People)

The new 90% rule doesn't change anything for you.

You already couldn't deduct gambling losses because you take the standard deduction. Your gambling winnings were already fully taxable.

The new law doesn't make your situation worse - it was already unfavorable from a deduction standpoint.

If You DO Itemize

The new law directly impacts you.

Previously, if you itemized, you could fully offset your gambling winnings with your losses (up to the winning amount). Now you can only offset 90%.

This creates a potential tax liability even when you break even or profit modestly.

The Math: Real Examples From My Betting History

Let me walk through this using my actual betting data from 2024 and 2025. These are real numbers from my Pikkit account - and seeing my own data really drove home how this law would have impacted me.

Understanding the Key Terms

Important: For tax purposes, the IRS requires you to report winnings and losses separately - you cannot simply report your net profit. (IRS Topic 419)

Winnings = profit from winning bets (payout minus your original wager)

Losses = total stakes lost on losing bets (cash wagers only - more on bonus bets below)

The phantom income formula:

Old rule: Deduct 100% of losses against winnings

New rule: Deduct only 90% of losses against winnings

Phantom income = 10% of your Losses (the portion you can no longer deduct)

Real Example #1: My 2024 Betting Year (8.6% ROI)

2024 was a strong year for me. Here are my actual numbers:

Total Handle: $122,736

Winnings (profit from winning bets): $96,525

Losses (cash stakes lost): $86,011

Net Profit: $10,514

ROI: 8.57%

Under the OLD rules (2024 actual):

Taxable gambling income: $10,514 (my net profit)

Tax at 22% bracket: $2,313

Under the NEW 2026 rules (theoretical):

Winnings: $96,525

Max deductible losses (90%): $77,410 (90% of $86,011)

Taxable gambling income: $96,525 - $77,410 = $19,115

Tax at 22% bracket: $4,205

The damage:

Phantom income: $8,601 (10% of my losses)

Additional tax from phantom income: $1,892

My net after taxes would drop from $8,201 → $6,309

That's an extra $1,892 in taxes on money I never made.

The good news: Because my ROI was high (8.6%), my losses were relatively contained compared to my winnings. This is about as good as the math gets for a +EV bettor.

Real Example #2: My 2025 Betting Year (2% ROI) - THE PAINFUL ONE

2025 was a grind. I increased my unit and increased my volume, but variance hit hard and at the end of the year my ROI was only 2%. This is where the new law really hurts:

Total Handle: $310,694

Winnings (profit from winning bets): $254,350

Losses (cash stakes lost): $248,127

Net Profit: $6,223

ROI: 2.00%

Under the OLD rules (2025 actual):

Taxable gambling income: $6,223 (my net profit)

Tax at 22% bracket: $1,369

Under the NEW 2026 rules (theoretical):

Winnings: $254,350

Max deductible losses (90%): $223,314 (90% of $248,127)

Taxable gambling income: $254,350 - $223,314 = $31,036

Tax at 22% bracket: $6,828

The damage:

Phantom income: $24,813 (10% of my losses)

Additional tax from phantom income: $5,459

My net after taxes would be: $6,223 - $6,828 = -$605

Read that again: I would have LOST $605 on a year where I was $6,223 profitable.

The phantom income tax alone ($5,459) would have been nearly as much as my actual profit. Combined with regular taxes on my real profit, I would have gone negative.

This is the nightmare scenario the new law creates.

Why Higher Volume + Lower ROI = Disaster

Looking at my two years side-by-side:

2024: $123K handle, 8.6% ROI, $10,514 profit, $86,011 losses → $8,601 phantom income → $1,892 extra tax

2025: $311K handle, 2.0% ROI, $6,223 profit, $248,127 losses → $24,813 phantom income → $5,459 extra tax

My 2025 losses were nearly 3x my 2024 losses, even though my profit was lower. That's what happens when you increase volume but hit variance.

The key insight: Phantom income = 10% of your LOSSES. The higher your losses, the worse this gets - regardless of whether you're profitable.

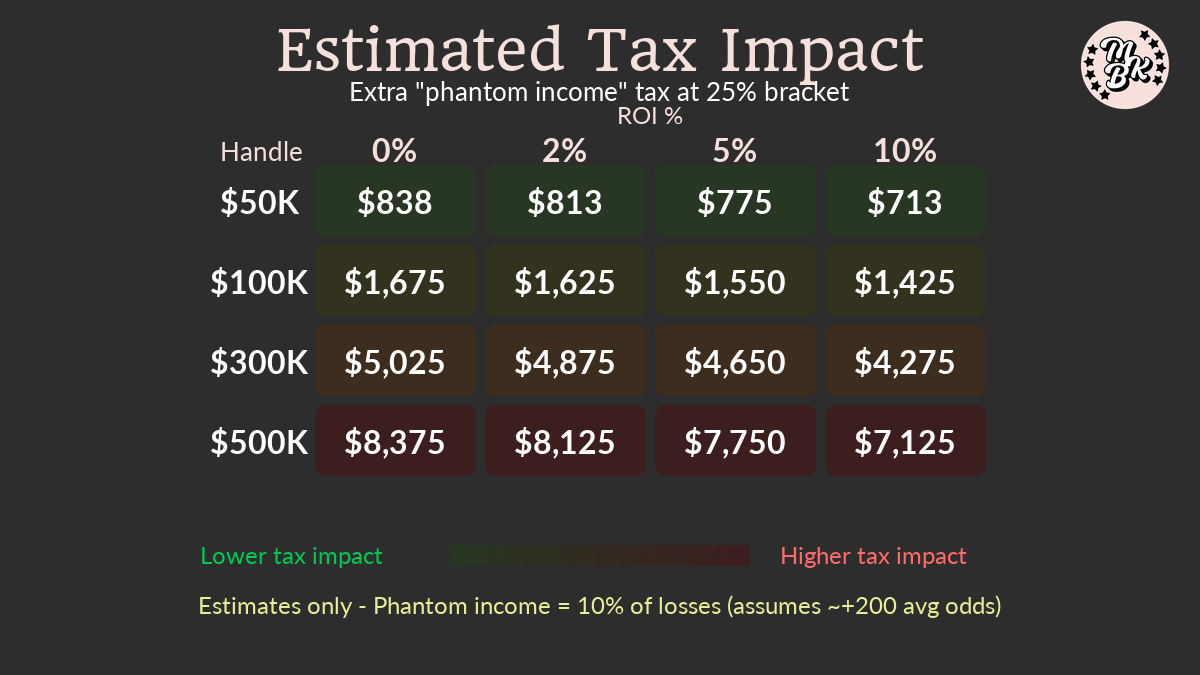

Here's a quick reference showing how different combinations of volume and ROI affect your tax exposure. These estimates assume average odds around +200 (typical for +EV prop betting), where approximately 65% of your handle ends up as losses on losing bets.

A Note on Bonus Bets and Free Bets

You might have noticed I said "cash stakes lost" above. That's because I track bonus bets and free bets separately.

Here's the situation:

When you lose a bonus bet, you didn't lose actual cash - you lost promotional credits

In my tracking, losing bonus bets show $0 P/L because I never actually risked my own money

However: Profits from winning bonus bets ARE taxable (you did receive real cash)

The tax question: Can you count bonus bet losses as gambling losses for deduction purposes?

Honestly, this is a gray area the IRS hasn't explicitly addressed. Technically, a "loss" should be an amount you actually wagered and lost. If you never wagered real money on a bonus bet, did you really "lose" anything?

My conservative approach: I only count actual cash losses in my tax calculations. This is exactly the kind of question you should ask a tax professional about your specific situation.

What About the "Session" Loophole?

You may have seen discussion online about using "sessions" as a potential way around this law. Here's what people are talking about:

The theory: Some tax interpretations suggest that gambling winnings and losses can be calculated on a per-session basis rather than per-bet. Under this interpretation, if you have a losing session (say, you bet $500 across 10 bets in one day and end up down $50), you'd report $0 in winnings and $50 in losses for that session - rather than reporting the gross winnings and losses from each individual bet.

Why this matters for the 90% rule: If you can net your results within sessions, your reported "Winnings" and "Losses" would be much smaller numbers (closer to your actual net results), which would significantly reduce or eliminate phantom income.

The reality: This is a very gray area and it's unclear whether this interpretation would hold up with the IRS, especially for sports betting. The IRS has historically applied session-based reporting to casino gambling (slots, table games), but whether it applies to sports betting - and how the new 90% rule interacts with it - is genuinely uncertain.

My strong recommendation: Do NOT assume this is a valid strategy without consulting a qualified tax professional who understands both gambling taxation and this new law. The stakes (pun intended) are too high to rely on internet speculation. This is exactly the kind of question you need professional guidance on.

Does Betting Longer Odds Help?

There's been some discussion about whether betting longer odds (like +500 or +1000) instead of shorter odds (like +150 or -110) would reduce your tax exposure under this law. Let me address this directly.

The short answer: Not meaningfully. Here's why.

The Logic That Seems Right (But Isn't)

The thinking goes: "If I bet longer odds, I win less often but win more when I do compared to my wager. So my losing bet would be smaller, which means fewer losses, which means less phantom income."

This sounds reasonable, but it misses the bigger picture.

The Reality

When you bet longer odds, yes - each winning bet pays more. But you also lose more bets because longer odds have lower win rates.

For the same handle and same ROI:

Shorter odds = more wins, smaller payouts, fewer losses

Longer odds = fewer wins, bigger payouts, more losses

These effects largely offset each other. Your total losses for the year are primarily determined by your handle and your ROI - not by the odds profile of your bets.

What Actually Determines Your Phantom Income

Your phantom income = 10% of your total losses. Your total losses depend on:

Your total handle - More wagered = more potential losses

Your ROI - Higher ROI = relatively fewer losses compared to winnings

Variance - How results actually play out vs. expected

The odds you bet at have minimal impact on your total annual losses when you control for handle and ROI.

Bottom Line

Don't restructure your betting strategy around odds length to try to minimize this tax. It's not a meaningful lever, and you might end up passing on good +EV opportunities for the wrong reason.

What actually helps: Lower volume, being more selective by focusing on higher EV% opportunities (which improves your ROI), and working with a tax professional. Looking for bets with stronger edges is something you can actually control - and it makes a real difference.

How to Calculate Your Impact

The tricky part is that you need to know your actual losses - not just your handle, profit and ROI. As my real examples showed, two bettors with similar handles can have very different loss totals based on their betting style and variance. There's no reliable shortcut here.

You Need to Track Your Bets

To know your real exposure, you need to track the key stats:

Winnings: Total profit from all winning bets

Losses: Total stakes lost on all losing bets (cash wagers only)

If you use Pikkit or another tracking service: Export your full bet history to a spreadsheet, filter to cash bets only (bets that made an +/- impact on your P/L - If P/L is $0, exclude it as it’s likely a bonus bet or voided bet), and calculate your totals.

If you track manually: Make sure you're recording both the stake AND the profit/loss for each bet, so you can calculate Winnings and Losses separately at year end.

When Do Bets Count? Settlement Date, Not Placement Date

An important detail for tracking: bets count toward the tax year when they settle, not when you place them.

If you place a futures bet in December 2025 on a team to win the Super Bowl, and the game happens in February 2026, that bet (win or loss) counts toward your 2026 taxes - not 2025. The same applies to any bet that crosses the calendar year boundary.

This matters for year-end planning. If you're trying to calculate your 2026 exposure, don't include bets you placed in 2026 that won't settle until 2027 (like season-long futures). And remember to include any bets placed in 2025 that settled in 2026.

Once you have your numbers:

Phantom Income = Losses × 10%

Extra Tax = Phantom Income × Your Tax Bracket

Track As You Go in 2026

Since this law is now in effect, I'd recommend keeping a running tally throughout 2026 so you're not surprised at tax time:

Running total of Losses (stakes on losing cash bets)

Phantom Income so far = Losses × 10%

Estimated extra tax liability = Phantom Income × Your Tax Bracket

This way you can monitor your exposure in real-time and make informed decisions about your betting volume as the year progresses.

Bottom line: If you want to understand how this law impacts YOU specifically, you need actual data from your betting history. The variance between betting styles is too large for rough estimates to be meaningful.

The Current Situation: Will This Be Repealed?

Here's the hopeful news: There's bipartisan support in Congress to repeal this provision.

What's Happening

Rep. Jason Smith (R-MO), Chairman of the House Ways and Means Committee and a key architect of the original bill, called this provision a "mistake" and committed to working on a fix

Rep. Dina Titus (D-NV) introduced the FAIR BET Act (H.R. 4304) on July 7, 2025, which would restore the 100% deduction

Sen. Catherine Cortez Masto (D-NV) introduced the FULL House Act in the Senate with the same goal

Both bills could be retroactive, meaning if passed, they might apply back to January 1, 2026 - effectively erasing this law's impact

Current Status

As of early January 2026, the law is in effect but repeal efforts are ongoing. A recent attempt to fast-track a repeal was blocked, but supporters continue to push for a fix.

Bottom line: There's a real chance this gets repealed or modified, but it's not guaranteed. For now, the 90% cap is the law.

Want to Make Your Voice Heard?

If this law impacts you and you want to push for repeal, contact your representatives:

Find your U.S. Representative: house.gov/representatives/find-your-representative

Find your U.S. Senators: senate.gov/senators/senators-contact.htm

Let them know how this law affects you as a constituent. The more people who speak up, the more pressure there is to fix this.

⚠️ DISCLAIMER REMINDER: Before acting on any of the suggestions below, please consult with a qualified tax professional. What makes sense for your situation depends on many individual factors that this article cannot address. The options below are for educational discussion only.

What Can You Do About It?

If you're a high-volume bettor who itemizes and this law significantly impacts you, here are some options to consider:

Option 1: Wait and See (Pause Betting Temporarily)

The case for pausing: If there's a reasonable chance the law gets repealed retroactively, you might consider reducing or pausing your betting until there's clarity.

Pros:

Avoids accumulating tax liability that might not exist if repealed

No risk of "phantom income" building up

Can resume immediately if repealed

Cons:

Miss out on +EV opportunities

No guarantee of repeal

Could be waiting indefinitely

Who this is for: Bettors who have significant tax exposure AND believe repeal is likely AND can afford to step away

Option 2: Lower Your Volume

The math reality: Lower volume = lower total winnings/losses = lower phantom income.

Instead of betting $500/day, betting $200/day cuts your exposure by 60%.

Pros:

Still participating in +EV betting

Significantly reduces tax exposure

Can scale back up if law changes

Cons:

Less profit potential

Might feel limiting

Still some phantom income (just less)

Who this is for: Bettors who want to stay active but reduce risk exposure

Option 3: Focus on Higher EV% Bets Only

The key insight from the math: When your ROI is ~7% or higher, your losses naturally stay under 90% of your winnings, eliminating phantom income.

This means being more selective:

Only taking higher EV% opportunities

Skipping marginal +EV plays

Potentially betting fewer markets but with stronger edges

Pros:

Can maintain or even increase profitability with less volume

Higher quality bets only

Less total risk exposure

May naturally avoid tax issue if ROI stays high enough

Cons:

Fewer betting opportunities

Requires discipline to pass on "good enough" plays

ROI isn't fully controllable (variance happens)

Who this is for: Bettors comfortable being more selective and patient

Option 4: Continue as Normal and Accept the Tax

The reality check: For lower-volume bettors, the extra tax - while annoying - might be manageable.

If you're betting $50,000/year at 5% ROI ($2,500 profit), your extra tax might be $700-1,000. That eats into profit but doesn't wipe it out.

At higher volumes, this becomes less viable. As my 2025 example showed, $310K handle at 2% ROI would have resulted in going negative after the phantom tax.

Pros:

No changes to your strategy

Keep capturing all +EV opportunities

Simple

Cons:

Accept the additional tax burden

Impact increases dramatically with volume

Can turn profitable years into losses (as my 2025 showed)

Who this is for: Lower-volume bettors whose tax exposure is manageable relative to their profits

**Option 5** (Do This No Matter What): Consult a Tax Professional About Your Specific Situation

I can't stress this enough: Everyone's tax situation is different.

A qualified CPA or tax professional can:

Determine if you even itemize (or should)

Calculate your actual exposure

Identify strategies specific to your situation

Help you understand the full picture

This is always the right answer if you're concerned about this issue.

What I'm Personally Doing

I want to be transparent about my own approach as 2026 begins. I file as a professional gambler and itemize my deductions, so this law directly impacts me. I'm personally utilizing Options 2, 3, and 5:

Lowering my volume - Not pausing entirely, but being more intentional about the bets I'm placing. I'm not trying to maximize every possible +EV opportunity anymore.

Focusing on higher EV% opportunities only - Being more selective and skipping the marginal plays. If the edge isn't strong enough, I'm passing. Quality over quantity.

Consulting my accountant - I've already reached out to my CPA to understand exactly how this impacts my specific tax situation and what strategies make sense for me.

This isn't advice for what YOU should do - everyone's situation is different. But I wanted to share what I'm actually doing in real-time as someone who this law directly affects. I'm taking it seriously, adjusting my approach, and working with a professional to navigate it.

Key Takeaways

1. This only affects you if you itemize your deductions. Most Americans take the standard deduction - if that's you, this law doesn't change your gambling tax situation.

2. The impact scales with volume and inverse to ROI. High volume + low ROI = worst case. Lower volume or higher ROI = less impact.

3. Repeal is possible but not guaranteed. Bipartisan efforts exist, but the law is currently in effect.

4. Calculate your actual exposure before panicking. Use the quick calculator above to estimate your situation.

5. Consult a tax professional. Seriously. This article is educational, not personalized advice.

⚠️ FINAL DISCLAIMER: This article provides general educational information about the 2026 gambling tax law changes. It is NOT tax advice, financial advice, or legal advice. Tax laws are complex and individual situations vary widely. Always consult with a qualified tax professional, CPA, or tax attorney before making any decisions based on this information. The author and MamaKnowsBets are not responsible for any actions taken based on this educational content.

Additional Resources

Have questions? Drop them in the VIP Discord and we can discuss. And remember - whatever happens with this law, the fundamentals of +EV betting don't change. Find value, manage your bankroll, and trust the process.

———

Want to learn more about +EV Betting? Check out our articles in the Mama Knows Bets Education Series: