Why Taking the Best Odds Matters, Part I: A Data-Driven Analysis

Part of the Mama Knows Bets Education Series. See also: [What is +EV Betting? - COMING SOON!], Bankroll Basics, How to Use the Value Finders, and [The Seven Deadly Sins of Betting - COMING SOON!].

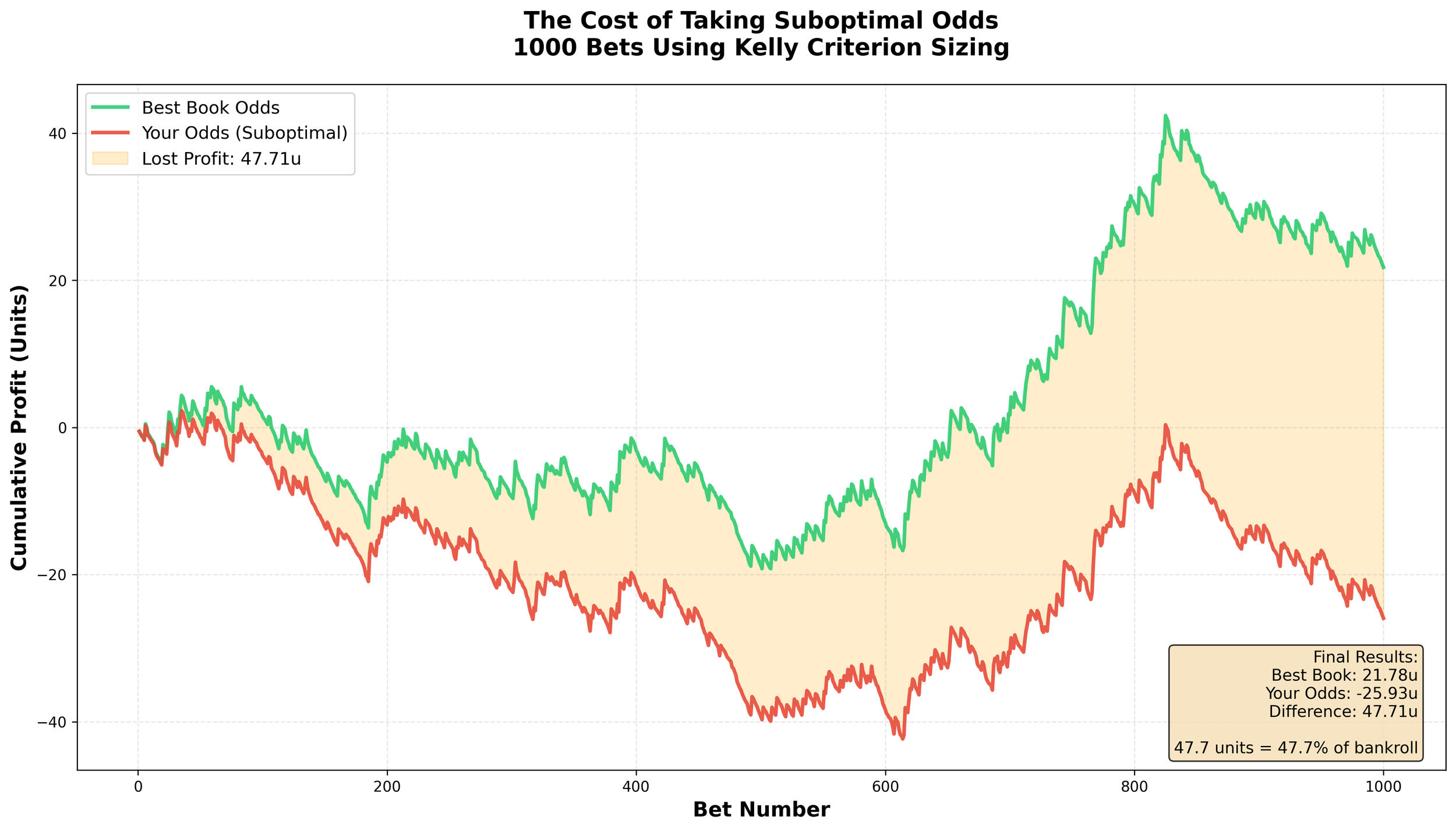

Taking suboptimal odds turned a +21u winning strategy into a -26u losing strategy. Same bets. Same analysis. 47.7 unit swing.

The Hidden Cost of "Good Enough" Odds

You've found a great betting opportunity. The fair value odds are +300, I'm recommending it at +360 on MGM, but you see it at +320 on DraftKings. Still positive EV, right? You take it anyway.

This decision, repeated over time, is costing you serious money.

The Simulation

I ran a Monte Carlo simulation to quantify exactly how much suboptimal odds cost you over time. Here's the setup:

Methodology

1,000 random bets with fair value odds between +120 and +1000 (Basically, a similar distribution to the way I bet, focused on longer odds bets with edge with occasional lower odds picks for boosts)

Best Book Odds: 2-10% edge on shorter odds, 5-15% on longshots (realistic sharp book range)

“Your Odds”: 5-20% worse than Best Book Odds - assuming someone is consistently taking the bets at worse odds than what is being recommended, but they are keeping their units THE SAME

Note: you could mitigate damage by rescaling your units per bet to an appropriate size, IF you still have a +EV bet. If the bet becomes negative EV at your odds, it should not be taken at all. This model assumes the “Your Odds” user is not doing that, and is taking the bets at the same recommended unit scale, but at the inferior odds. I cover this topic in Part 2!

Unit Sizing: Kelly Criterion using Quarter Kelly sizing, where 1 unit = 1% of bankroll

Outcomes: All bets hit at their fair value implied probability (law of averages)

This mirrors real betting conditions where you see solid +EV opportunities from an odds screen or a capper that you trust, but you are personally settling for inferior odds by taking them at a different book or after the odds have dropped.

The Results

After 1,000 bets using identical unit sizing and hitting at the same rate:

Best Book Odds Performance

Final Profit: +21.78 units, +21.8% ROI

“Your Odds” Performance

Final Profit: -25.93 units, -25.93% ROI

Same opportunities, worse execution = losses!

The Damage

Taking suboptimal odds turned a winning strategy into a losing one

Best Book made +21.78 units. Your Odds LOST 25.93 units. That's a 47.71 unit swing - nearly half your entire bankroll.

Why This Happens

Here's the key: small odds differences aren't small at all

Let me show you what I mean with a real example:

You identify a player prop with fair value of +300 (25% chance to hit).

Scenario 1: You take Best Book Odds at +360

You bet 0.5 units ($50 on a $10K bankroll)

When it hits, you profit $180

EV: 15.1%

This is a GOOD bet

Scenario 2: You take "Your Odds" at +320

You bet the same 0.5 units ($50)

When it hits, you profit $160

EV: 5.1%

This is an OK bet

You just gave away $20 in profit. On one bet. Even though you still had a +EV bet!

"But it's just $20..." you think.

Here's where it gets brutal:

You make this same trade-off 1000 times over a season. Sometimes it's +360 vs +320. Sometimes it's +540 vs +480. Sometimes it's +185 vs +165.

Every. Single. Time. You're giving back 5-20% of your profit potential.

The simulation proves what happens:

Best Book: Small edges compound into +21.78 units over 1000 bets

Your Odds: Those same opportunities bleed into -25.93 units

Don’t let FOMO trick you into taking sub-optimal odds that will cost you long term! Make sure you’re taking the best possible odds you can get that are always HIGHER than the forecasted Fair Value odds. This is how you win long term!

The Silent Killer: When +EV Becomes -EV

Here's the part that really stings.

In our 1000-bet simulation, 733 bets (73.3%) went from positive EV to NEGATIVE EV just by taking suboptimal odds.

Let me show you exactly what that looks like:

The Bet: A player prop with fair value odds of +200 (33.3% true probability)

Best Book Odds: +215

Implied probability: 31.75%

You're getting better odds than the true probability

EV: +5.0%

This is a GOOD bet. You should take it.

Your Odds: +185

Implied probability: 35.09%

You're getting WORSE odds than the true probability

EV: -5.0%

This is a BAD bet. You should not take it.

Same opportunity. But by taking different odds, one is profitable long-term, one isn't.

The odds difference of +215 vs +185 looks small - just 30 points. But it's the difference between making money and losing money.

This is happening on nearly 3 out of every 4 bets in the simulation. You do all the work to find +EV opportunities, then hand that edge right back to the book by taking inferior lines.

This is the real reason the "Your Odds" model lost money while the Best Book model won. It's not just that you're making less on winners - you're actively making -EV bets that you think are +EV.

The Real-World Impact

Let's put this in concrete terms:

If your bankroll is $10,000:

1 unit = $100 (1% of bankroll)

Best Book approach: +$2,178 profit (+21.8% ROI)

Your Odds approach: -$2,593 LOSS (-25.9% ROI)

Total swing: $4,771

You didn't just leave money on the table - you went from winner to loser. Same analysis, same opportunities, just worse odds execution.

But I Still Have Positive EV, some of the time!

“Some of the time” isn’t enough. When you degrade your odds by 5-20% every bet, your positive EV - and your profit! - evaporates.

The simulation showed Your Odds lost money while Best Book won. Taking suboptimal odds doesn't just reduce profits - it can turn winners into losers.

The Fix: Line Shopping as Non-Negotiable

Here's what winners do:

Have accounts at multiple books (as many as are allowed in your state - having 4+ books is ideal!)

Never settle for "good enough" if better exists!

Use odds comparison tools (like our Value Finder! Or any other odds screen or line shopping tool)

Be patient, and don’t get FOMO! It’s better to wait for the next profitable opportunity to come around then to invest precious resources into a bet that has lost its edge.

Taking the best available odds isn't optional for serious bettors. It's the difference between good and great results.

The same bankroll. The same opportunities. The same analysis.

47.71 units of difference over 1000 bets.

Best Book: +21.78u. Your Odds: -25.93u.

Don't work harder. Work smarter. Take the best odds, every single time!

Simulation Details

All calculations use the same Kelly Criterion formula as our Value Finders

Kelly = (bp - q) / b

where:

b = decimal_odds - 1

p = fair_value_probability

q = 1 - p

Unit Recommendation = Kelly * 25

(where 1 unit = 1% of bankroll)

Every bet in this simulation had positive EV using Best Book odds. Unit sizing was identical for both scenarios. The only variable was odds quality.

How to Use the Value Finders Correctly

This scenario is exactly why I built the Value Finders the way I did - and why you need to use them correctly.

When an opportunity shows up on the Value Finder, it's telling you three critical pieces of information:

The Best Book: where you should place the bet

The Best Book Odds: the specific line that makes it +EV

The Unit Recommendation: how much to bet at those exact odds

All three of these are connected. The unit recommendation is calculated based on those specific odds at that specific book. Change any variable and the math changes.

Here's how to execute properly:

Scenario 1: The odds are still available

You see an opportunity: Player X Over 0.5 Goals at +360 on DraftKings, 1u recommendation. Fair odds are +300 (25% implied probability).

You check DraftKings - It's still +360. Take the bet exactly as shown.

Scenario 2: The odds have moved against you slightly

Same opportunity, but now DraftKings shows +340 instead of +360.

The EV is lower. The correct play is to recalculate your stake. A +340 line has less edge than +360, so you should bet less - 0.75u instead of 1u. Use an odds/kelly calculator to determine the exact proper new stake (one will be coming to MKB soon!)

If you don't want to do the math, a simple rule: reduce your stake by roughly the same percentage the odds dropped.

Scenario 3: The odds have moved significantly

The Value Finder showed +360, but now it's +280. At Fair Odds of +300, this is now BELOW fair odds.

Don't take the bet. The edge is gone. You're in -EV territory now. Move on to the next opportunity.

Scenario 4: You can only get it at a different book

The Value Finder shows +360 on DraftKings, but you don't have a DraftKings account. Your best option is +320 on FanDuel.

This could be a trap. You found the opportunity, you want to bet it, but +320 might be -EV even though +360 was +EV.

Make sure it's still +EV at your odds. If the fair value is +300 and you're getting +320, you still have a small edge - recalculate your stake and you can still take the bet. BUT, if the fair value was +340 and you're getting +320, you're now -EV. Pass on it.

The Bottom Line for Value Finder Users

The opportunities the Value Finder surfaces are +EV at the odds shown, at the book shown, at the time shown.

Treat those three things as a package deal:

Right book, right odds → Take the full recommended stake

Right book, worse odds → Reduce your stake proportionally

Wrong book, close odds → Only take it if you verify it's still +EV

Odds moved too much → Skip it entirely

The 47.71 unit swing in this simulation? That's what happens when you consistently take "close enough" odds instead of the exact opportunities identified.

Common Excuses (And Why They're Costing You Money)

"But I don't have access to that book"

Then get access! Opening a new sportsbook account takes 10 minutes. If you're serious about not losing money, having multiple books is non-negotiable. The simulation proves it. If you don’t have access to a book with better than fair value odds, skip the bet.

"The difference is only a few cents on the dollar"

A few cents per bet becomes a 47 unit swing over 1000 bets. That's the difference between +$2,178 and -$2,593. Still think it's just pennies?

"It's too much work to check multiple books"

It takes 2 minutes (or less!) to line shop. It costs you time to find an edge, navigate to the best book, and place the bet. Why would you throw away that valuable time by taking bad odds that won’t make you profit in the long term? Plus, using an odds shopping tool like the Value Finder makes this is as easy as pie!

"I still made money when my bet hit with the suboptimal odds!"

The simulation shows Your Odds LOST money overall while Best Book won. Variance helps you sometimes, but the math will crush your profitability over time. It’s just not worth it.

Bottom Line: Line shopping isn't just about squeezing extra profit from winners. It's about the difference between being a winner and a loser. The simulation proves it: Best Book won, Your Odds lost. That's not hyperbole. That's math.

--

** This is Part 1 of our series on why taking the best odds matters. To learn what happens when you re-size your stake appropriately for your new odds, read Part 2! **

Ready to Level Up?

〰️

Ready to Level Up? 〰️

Getting Value Odds matters! Learn more about joining our VIP community, or join now below.

Unlock full access to the Mama Knows Bets VIP Discord and Website with an All Access VIP membership. Line shop with our Value Finders and explore all players across all our Value Models everyday (including VIP exclusive props!) with expanded data metrics. Sort, filter and export to find your next best play.