What is +EV Betting? The Foundation of Profitable Sports Betting

Part of the Mama Knows Bets Education Series. See also: Bankroll Basics, Why Taking the Best Odds Matters, How to Use the Value Finders, and [The Seven Deadly Sins of Betting - COMING SOON!].

The Single Most Important Concept in Betting

If you take away one thing from everything I teach, let it be this: positive expected value (+EV) is the only thing that matters for long-term profitability.

The only thing that determines whether you'll make money or lose money over time is whether your bets have positive expected value.

Let me explain exactly what that means - and why it changes everything about how you should think about betting.

What is Expected Value?

Expected Value (EV) is a mathematical concept that tells you how much you can expect to win or lose on average per bet over the long run.

Positive EV (+EV): The bet is expected to be profitable over time

Negative EV (-EV): The bet is expected to lose money over time

Here's the key insight: every single bet at a sportsbook has an expected value. And that expected value is either working for you or against you.

The Coin Flip Example

Let me start with the simplest possible example.

Imagine I offer you this bet: I flip a fair coin. If it lands heads, you win $110. If it lands tails, you lose $100.

Should you take this bet?

The math:

Probability of heads: 50%

Probability of tails: 50%

Win amount: +$110

Loss amount: -$100

Expected Value = (50% × $110) + (50% × -$100) Expected Value = $55 - $50 = +$5

On average, you expect to make $5 every time you take this bet. That's +EV. You should take it every single time I offer it to you.

Now flip it: Heads you win $100, tails you lose $110.

Expected Value = (50% × $100) + (50% × -$110) Expected Value = $50 - $55 = -$5

On average, you expect to LOSE $5 every time. That's -EV. You should never take this bet.

This is the entire foundation of profitable betting. Find bets where the expected value is positive. Avoid bets where it's negative.

How Sportsbooks Work (And Why Most Bettors Lose)

Here's the uncomfortable truth: most bets at sportsbooks are -EV.

This is how sportsbooks make money. They don't need to pick winners - they just need to set lines where the expected value works in their favor.

The Vig Explained

When you see a typical bet at -110 on both sides, here's what's really happening:

A coin flip bet with true 50/50 odds

Fair odds would be +100 on both sides (bet $100 to win $100)

But the book offers -110 on both sides (bet $110 to win $100)

Your EV on this bet:

Win probability: 50%

Win amount: +$100 (your winnings)

Loss amount: -$110 (your stake)

EV = (50% × $100) + (50% × -$110) = $50 - $55 = -$5

Every time you bet $110 on a 50/50 proposition at -110, you expect to lose $5 on average. That's the vig (or juice). That's the sportsbook's edge.

The Scale of the Problem

The standard -110 line represents about a 4.5% house edge. That might not sound like much, but:

Bet 100 times at $100: expect to lose ~$450

Bet 500 times at $100: expect to lose ~$2,250

Bet 1000 times at $100: expect to lose ~$4,500

This is why recreational bettors lose over time. It's not bad luck. It's math. The expected value is negative, and eventually the math catches up.

How +EV Betting Flips the Script

So how do we beat the sportsbooks? We find bets where the expected value is positive - where the math is on OUR side instead of theirs.

Here's how that happens:

The Formula

EV = (Win Probability × Win Amount) - (Loss Probability × Loss Amount)

For a bet to be +EV, we need: (Probability × Payout) > (Risk)

Or in simpler terms: the odds the book is offering need to be BETTER than the true probability of the outcome.

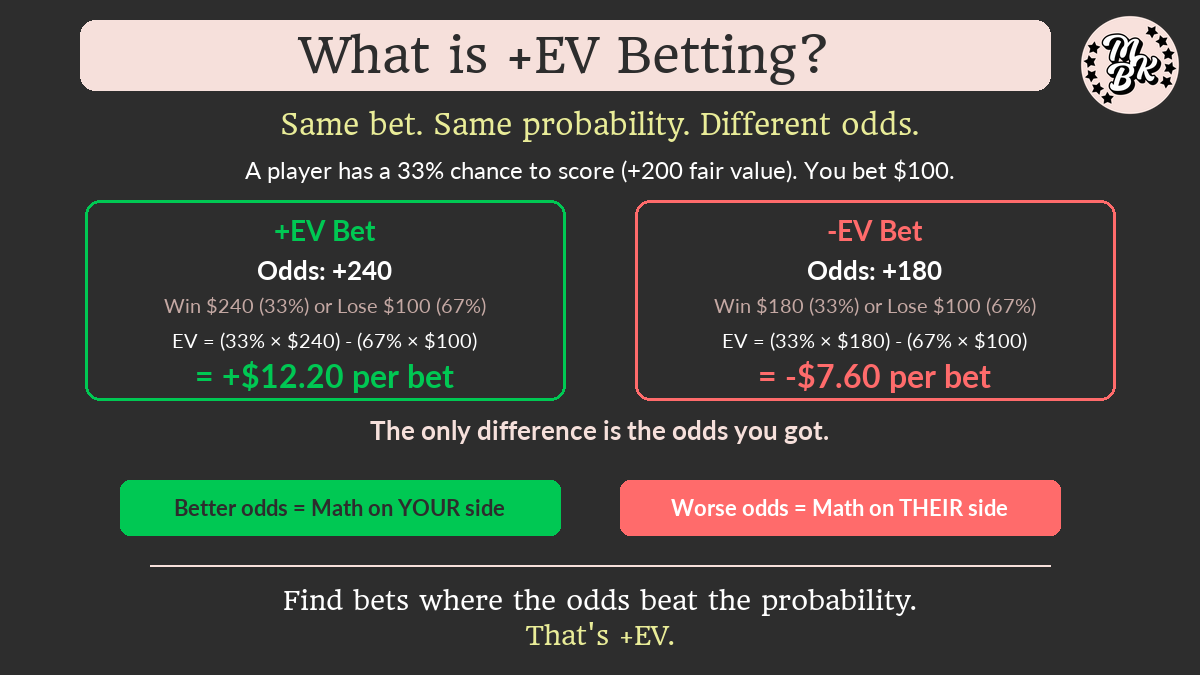

A Real Example

Let's say I've calculated that a player has a 33% chance to score a goal tonight (fair value of +200).

Scenario 1: The book offers +180

Implied probability at +180: 35.7%

True probability: 33%

You're getting WORSE odds than the true probability

This is -EV (don't bet)

Scenario 2: The book offers +240

Implied probability at +240: 29.4%

True probability: 33%

You're getting BETTER odds than the true probability

This is +EV (bet this!)

EV Calculation for +240:

Win: 33% × $240 = $79.20

Lose: 67% × $100 = $67.00

EV = $79.20 - $67.00 = +$12.20 per $100 bet

That's a 12.2% edge. Every time you make this bet, you expect to make $12.20 on average.

Where Does +EV Come From?

You might be wondering: if sportsbooks are so smart, why would they ever offer +EV bets?

Great question. Here's where the edges come from:

1. Market Inefficiencies

Sportsbooks set millions of lines. They can't perfectly price every single one. Player props, in particular, are less efficient than main lines because:

Less betting volume means less market correction

Books often copy each other's lines without independent analysis

Injuries, lineup changes, and late information can create mispricings

2. Different Books, Different Lines

This is huge. Different sportsbooks have different odds on the same bet. One book might have a player at +240 while another has the same player at +180.

If the true probability is 33% (+200 fair value), then:

+240 is +EV (take it)

+180 is -EV (skip it)

Same bet, different expected value. This is why line shopping is critical - and why you need accounts at multiple books.

3. Sharp vs. Soft Books

Some books are considered "sharp" - they take large bets from professional bettors and their lines are very accurate. These sharp lines serve as a benchmark for calculating fair value.

Other books (retail books like DraftKings, FanDuel, BetMGM) sometimes have soft lines that are out of sync with the sharp market. When a retail book is offering significantly better odds than the sharp consensus, that's often a +EV opportunity you can actually bet at.

4. Timing

Lines move. Early lines are often less accurate than lines closer to game time. If you can identify value before the market corrects, you can lock in +EV odds that disappear later.

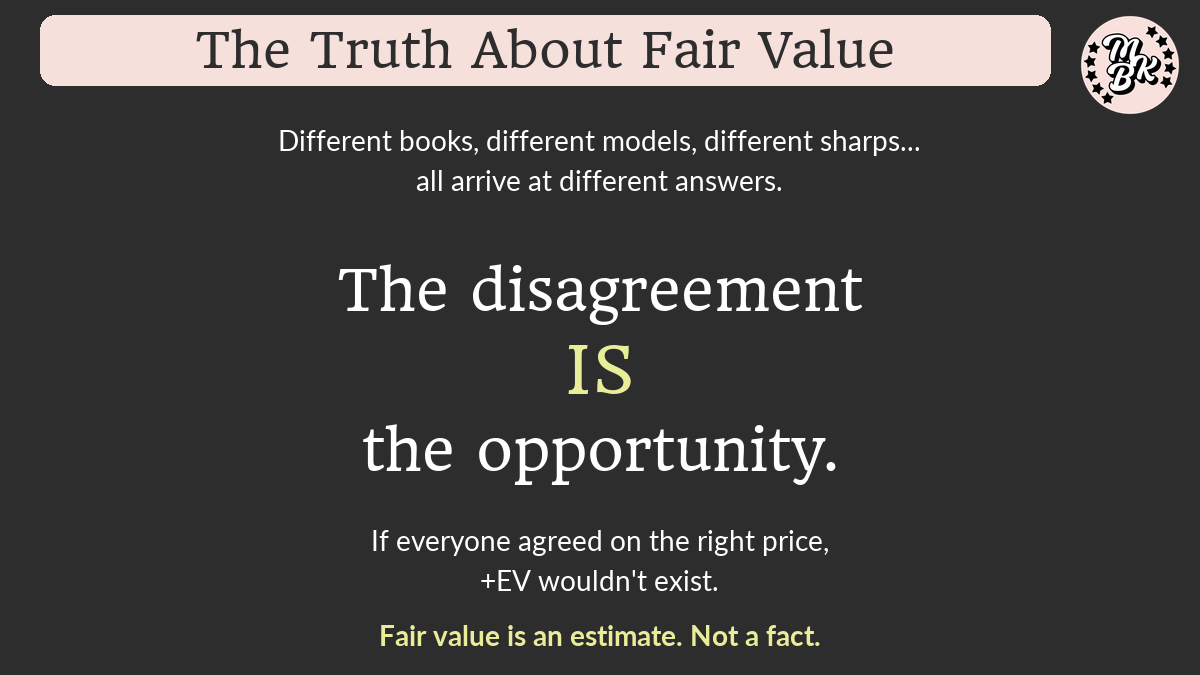

The Truth About "Fair Value"

Here's something important that often gets glossed over: determining fair value is not black and white.

Fair Value is an Estimate, Not a Fact

When I say a player has a "33% chance to score" or "fair value of +200," I'm not stating an objective truth. I'm stating an estimate based on a model or methodology.

The reality is:

Different sharp bettors will calculate different fair values

Different models will produce different probabilities

Different books arrive at different odds using their own sophisticated approaches

No one knows the "true" probability - it doesn't exist in a discoverable way

This is actually WHY +EV opportunities exist in the first place.

Why Books Have Different Lines

Think about it: if there were one objectively correct probability for every bet, every book would have the same odds (plus their vig). But they don't.

DraftKings might have a player at +180 while FanDuel has +220. Both books have teams of quants, data scientists, and algorithms. Both are trying to set accurate lines. They just arrive at different answers.

This disagreement IS the opportunity. When books disagree significantly, at least one of them is "wrong" relative to the others. If you consistently take the side that's offering better value, you profit over time.

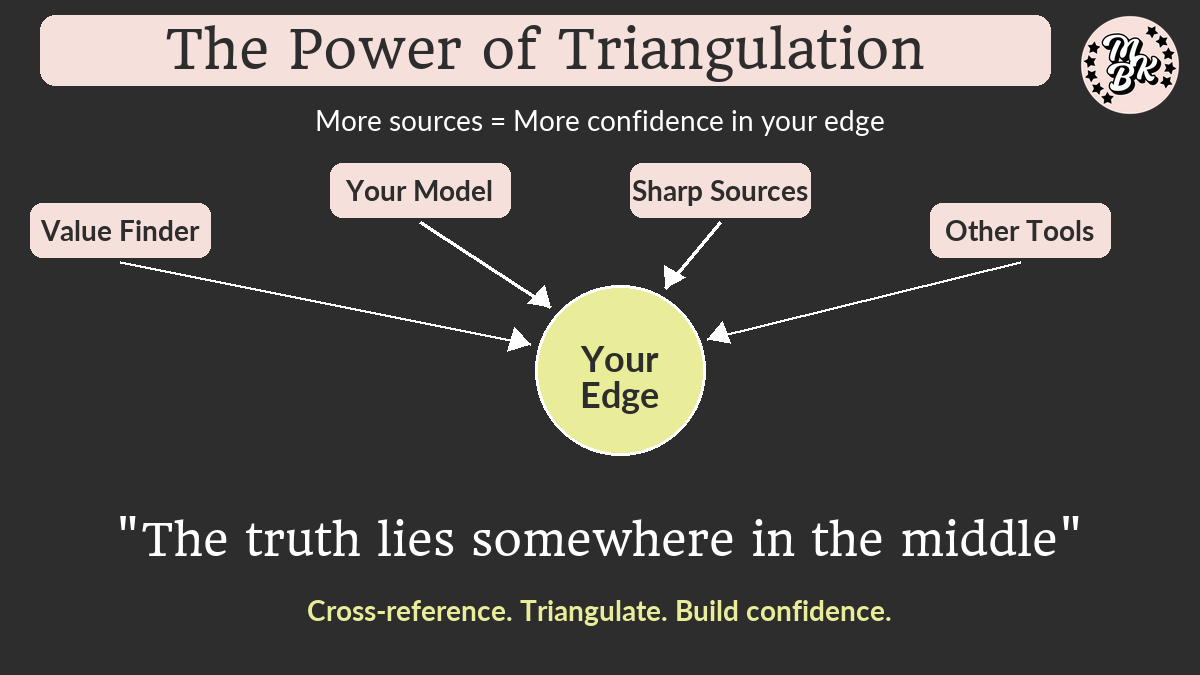

How the Value Finders Calculate Fair Value

My approach uses a weighted book average focused on sharper book consensus to establish fair value. The logic is:

Sharp books take large bets from professional bettors

They can't afford to have soft lines or they'd get crushed

Their lines are the most battle-tested and accurate in the market

When retail books deviate significantly from sharp consensus, that's often an opportunity

The truth lies somewhere in the middle

I refine my book weightings over time based on how I’m seeing results come in - when a book consistently prices their lines high, could a bettor profit on those opportunities? Or still end up in the red? Where they rank compared to the other books determines their weight. This process is repeated for each unique market.

But I want to be transparent: this is one approach, not THE approach.

Other valid approaches include:

Building your own probability models from historical data

Using proprietary algorithms trained on specific sports/markets

Weighting each book differently based on a different methodology or approach

Incorporating real-time information like injuries, weather, lineups

All of these can work. None of them are perfect. The Value Finders give you one well-reasoned methodology, but they're not infallible.

The Power of Triangulation

Here's my philosophy: the truth lies somewhere in the middle.

I fully support using any tools, models, or resources that help your process! The more sources of information you can pull from, the better. There's a ton of great stuff out there.

The smart approach is triangulation - don't rely on any single source to determine fair value. Cross-reference multiple tools. If your model, the Value Finder, and two other sharp sources all agree a bet is +EV, that's more confidence than if only one tool flags it. If they disagree significantly, dig deeper or size down.

Many sharps who win long-term aren't blindly following one methodology. They're synthesizing information from multiple angles and making informed decisions.

Use everything at your disposal. The Value Finders are one tool in your toolkit - not the only tool. The more you can triangulate across different perspectives, the more confident you can be in your edge.

Why This Matters for You

Understanding that fair value is an estimate has practical implications:

Don't treat +EV as guaranteed profit on any single bet. Even if the fair value calculation is slightly off, individual bets have huge variance.

Higher EV% provides more margin for error. If the Value Finder shows 15% EV and the true edge is actually 8%, you're still +EV. If it shows 3% EV and the true edge is -1%, you're underwater.

The Confidence Recc. U exists for this reason. It scales down sizing when we're less confident in the fair value - when fewer books are reporting or when the market is thin.

Volume smooths out model imperfections. Over hundreds of bets, if your methodology is directionally correct, you'll profit even if individual fair values are slightly off.

The goal isn't to be perfectly right on every fair value calculation. The goal is to be systematically right over time - to have an edge on average that compounds into real profit.

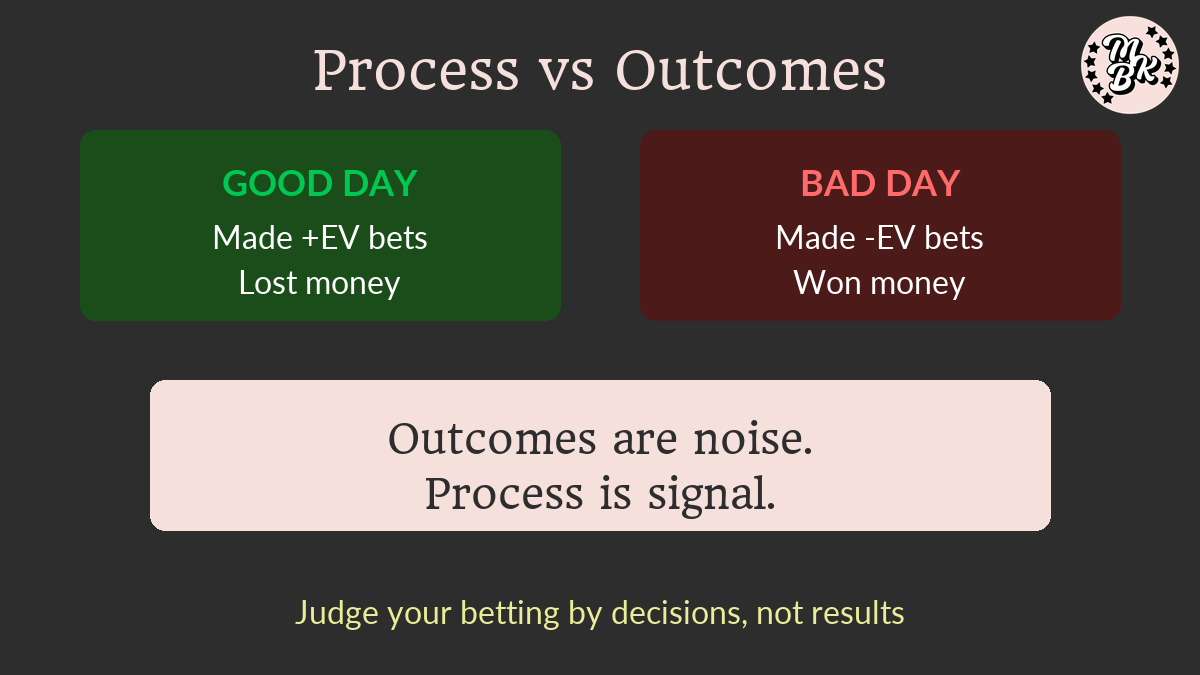

Why +EV is the ONLY Thing That Matters

Here's where this gets philosophical, and I need you to really internalize this:

Individual bets don't matter. Expected value is all that matters.

A +EV bet can lose. In fact, +EV bets lose all the time. If a bet has a 33% chance of winning, it's going to lose 67% of the time. That's not bad luck - that's exactly what should happen.

But here's the magic: if you consistently make true +EV bets, you WILL profit over time. It's mathematically guaranteed*, given enough volume. *Reminder though that due to fair value being an ESTIMATE and not a FACT per above, you need to battle test the methodology of your chosen “+EV” strategy to ensure true profitability over time.

This is called the Law of Large Numbers. Over enough bets, your actual results will converge toward your expected results.

The Mental Shift

Most bettors think in terms of wins and losses. "I won last night" or "I lost last night."

+EV bettors think differently. They ask: "Did I make +EV bets last night?"

If you made +EV bets and lost? Good day. You did the right thing. If you made -EV bets and won? Bad day. You got lucky, but the process was wrong.

Outcomes are noise. Process is signal.

The Variance Reality Check

This is where a lot of people struggle, so I want to be completely honest with you.

Even with perfect +EV betting, you will experience:

Losing days

Losing weeks

Losing months

This is called variance, and it's completely normal.

I've been on brutal cold streaks where value plays just weren't hitting. I got my butt kicked by MLB almost an entire summer, even though I was betting good lines. Finally at the end of the season I hit positive variance and made it all back and more.

The key is staying the course. If you're making +EV bets with proper bankroll management, the math eventually works out. But "eventually" can take longer than you expect.

This is why:

You need proper bankroll management (1 unit = 1% of bankroll)

You need patience

You need to trust the process even when it hurts

Common +EV Questions

"How do I know if something is +EV?"

This is what the Value Finders are for. I do the math to calculate fair value and surface opportunities where books are offering better odds than that fair value.

The key metrics:

EV%: How much edge the bet has

Fair Value: What the true odds should be

Best Book Odds: Where to get the best available line

If the Best Book Odds are better than Fair Value, it's +EV.

"Does +EV guarantee I'll win?"

No. Absolutely not. +EV guarantees you'll profit over time with enough volume. Individual bets can (and will) lose.

If you make one +EV bet, you might lose it. If you make 10 +EV bets, you might be down. If you make 100 +EV bets, you should be ahead. If you make 1000 +EV bets, you will almost certainly be profitable. Remember, this is the Law of Large Numbers.

"What's a good EV%?"

Any positive EV is good. But realistically:

2-5% EV: Solid opportunities worth taking

5-10% EV: Strong opportunities

10%+ EV: Excellent opportunities (often correct quickly)

The higher the EV%, the more confident you can be. But even small edges are worth taking consistently.

"Can I be a +EV bettor without the Value Finders?"

Yes! You could use other tools, or take a different approach that requires more work:

Building or accessing sharp probability models

Constantly comparing lines across multiple books

Understanding market dynamics and timing

Doing the math on every opportunity

The Value Finders do this work for you and surface the opportunities that pass the +EV test.

The Relationship Between +EV and Other Concepts

+EV and Line Shopping

These are deeply connected. A bet might be +EV at one book and -EV at another.

In my odds education simulation, taking suboptimal odds turned a +21.78 unit winner into a -25.93 unit loser. Same bets, different odds. 73% of bets went from +EV to -EV just by taking slightly worse lines.

Line shopping isn't optional - it's how you ensure you're actually getting +EV.

+EV and Bankroll Management

Having +EV isn't enough if you blow your bankroll before the math works out.

Proper sizing (1 unit = 1% of bankroll) ensures you:

Survive variance and losing streaks

Stay in the game long enough for +EV to pay off

Don't over-bet even on good opportunities

Read our blog post to learn more about proper Bankroll Management!

+EV and the Kelly Criterion

The Kelly Criterion is a formula for optimal bet sizing based on your edge. Bigger edge = bigger bet (up to a point).

This is how the unit recommendations on the Value Finder are calculated. A 10% EV bet gets a bigger unit recommendation than a 3% EV bet.

I'll explain Kelly in more detail below - it's important enough to deserve its own section.

The Kelly Criterion: Optimal Bet Sizing

The Kelly Criterion is one of the most important concepts in +EV betting after expected value itself. It answers the question: "I found a +EV bet - how much should I wager?"

The Problem Kelly Solves

Finding +EV isn't enough. You also need to size your bets correctly.

Consider two extremes:

Bet too small: You're leaving money on the table. Your edge isn't fully utilized.

Bet too big: You risk ruin. Even with +EV, variance can wipe you out.

Kelly finds the mathematically optimal balance - the bet size that maximizes long-term bankroll growth while managing risk.

The Formula

Kelly % = (bp - q) / b

Where:

b = the decimal odds minus 1 (what you win per $1 bet)

p = your probability of winning

q = your probability of losing (1 - p)

A Real Example

Let's say you find a bet at +200 odds where you believe the true probability is 40%.

b = 2.0 (you win $2 for every $1 bet)

p = 0.40 (40% chance to win)

q = 0.60 (60% chance to lose)

Kelly = (2.0 × 0.40 - 0.60) / 2.0 Kelly = (0.80 - 0.60) / 2.0 Kelly = 0.20 / 2.0 Kelly = 0.10 or 10%

Full Kelly says bet 10% of your bankroll on this opportunity.

Why We Use Fractional Kelly

Here's the thing: full Kelly is aggressive. Really aggressive.

Full Kelly maximizes long-term growth, but the ride is bumpy. You'll experience massive swings. Most bettors can't handle the volatility emotionally, and making emotional decisions is how you lose.

The solution: Fractional Kelly

Instead of betting the full Kelly amount, we use a fraction:

Half Kelly: Bet 50% of what Kelly recommends

Quarter Kelly: Bet 25% of what Kelly recommends

The Value Finders use Quarter Kelly (Kelly × 0.25, then scaled so 1 unit = 1% of bankroll).

Why quarter Kelly?

Smoother ride with less variance

More forgiving if our probability estimates are slightly off

Psychologically easier to stick with during downswings

Still captures most of the edge over time

Using our example above: Full Kelly said 10%, so Quarter Kelly says 2.5% of bankroll.

What Kelly Tells You

Kelly isn't just about how much to bet - it also tells you when NOT to bet.

If Kelly returns zero or negative, the bet is -EV. Don't take it.

This is powerful. Kelly protects you from bets that look tempting but actually don't have an edge. In part 2 of my odds education simulation, when we recalculated Kelly for suboptimal odds, 74.6% of bets got skipped entirely because Kelly said "this is no longer +EV at these odds."

The Kelly Mindset

Here's how to think about Kelly:

Higher edge = larger bet: Kelly sizes up when you have more edge

Lower edge = smaller bet: Kelly sizes down when edge is thin

No edge = no bet: Kelly goes to zero when EV disappears

Higher probability = larger bet: A likely outcome with a small edge can warrant a bigger bet than a long shot with a large edge

This is why the unit recommendations on the Value Finder vary. A 10% EV opportunity might be 0.5u while a 3% EV opportunity might be 0.15u. Kelly is doing the math to optimize your sizing based on your actual edge.

Kelly and Bankroll Survival

The beautiful thing about Kelly is that it's designed to never go broke.

Because Kelly sizes bets as a percentage of your current bankroll, you mathematically cannot lose everything (in theory). As your bankroll shrinks, your bet sizes shrink proportionally. As it grows, your bets grow.

This is why bankroll management and Kelly work together. Your 1 unit = 1% of bankroll. Kelly tells you how many units to bet. The system self-corrects.

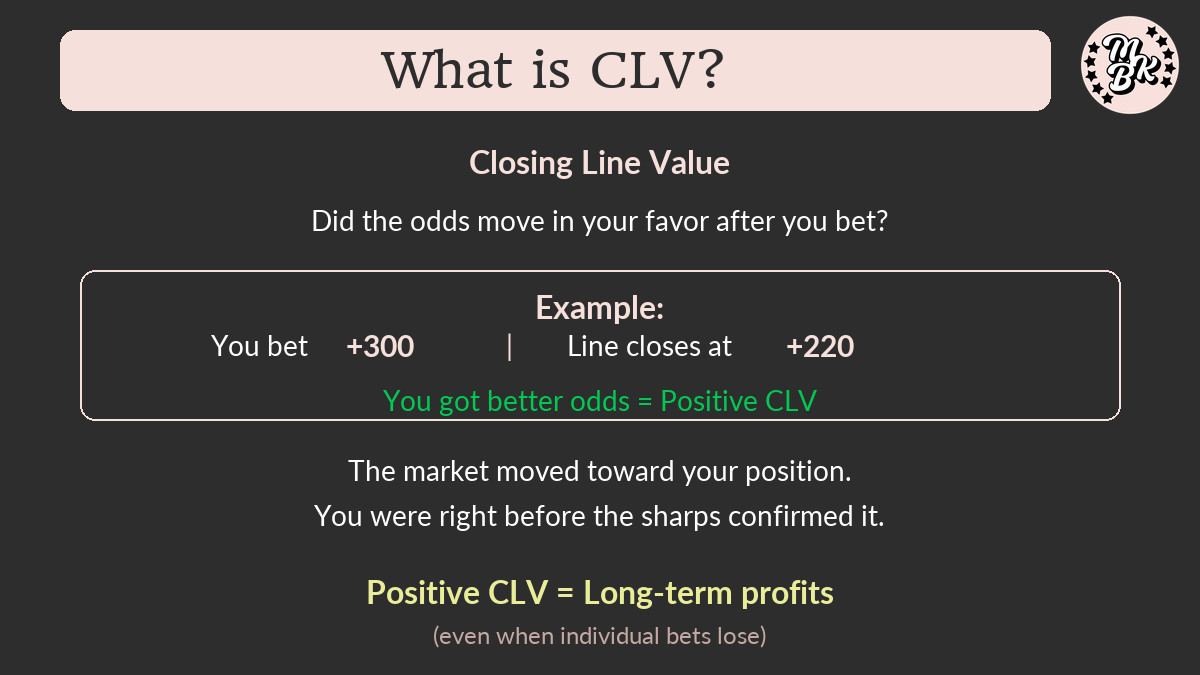

Closing Line Value (CLV): Measuring Your Edge

You've probably heard the term "closing line value" or "CLV" thrown around. Let me explain what it means and why it matters.

What is CLV?

Closing Line Value is the difference between the odds you took and the odds at market close (when the game starts).

The "closing line" is the final line before a game begins. It's considered the most accurate line because it incorporates all available information and betting action up to that point.

Why CLV Matters

Here's the key insight: if you consistently beat the closing line, you are almost certainly a long-term winner.

Think about it this way:

The closing line represents the market's best estimate of true probability

If you're getting better odds than the closing line, you're getting +EV

If you consistently get better odds than closing, you're consistently finding +EV

CLV is the closest thing we have to proving you're a winning bettor before the long-term results come in.

A CLV Example

You bet Player X to score at +300 this morning.

By game time, the line has moved to +240.

Your CLV = +300 vs +240

You got 25% better odds than the closing line. That's positive CLV. The market moved toward your position, confirming you identified value before everyone else did.

CLV vs Actual Results

Here's something important to understand:

In the short term, CLV is a better indicator of skill than actual results.

Why? Because results include variance. You can make great +EV bets and lose. You can make terrible -EV bets and win. Over 50-100 bets, luck plays a huge role.

But CLV measures process. If you're consistently beating the closing line, your process is good - even if you're running cold.

Over thousands of bets, actual results and CLV should converge. But in the short term, trust your CLV more than your P/L.

Tracking CLV

To track CLV:

Record the odds you took when you placed the bet

Check the odds at game time (closing line)

Compare them

This is harder for player props than main lines because prop lines aren't always available at close. But for markets where you can track it, CLV is incredibly valuable feedback.

Tip: Apps like Pikkit can help you track your bets and CLV. Use code “MAMABETS” if you would like to sign up!

CLV and the Value Finders

The Value Finders are designed to find opportunities where books are out of line with the sharp market. If you're taking the Best Book odds shown, you're likely to have positive CLV because:

You're taking odds that are better than the market consensus

Those odds often correct (move toward fair value) before game time

Positive CLV is built into the process.

CLV and Cash Out Offers: Why You Should Almost Never Take Them

Here's where CLV becomes incredibly practical: cash out offers are a real-time signal of your CLV.

When a sportsbook offers you a cash out for MORE than you wagered, they're telling you something important: the line has moved in your favor. You have positive CLV. The book now sees your bet as more likely to win than when you placed it, and they're trying to limit their exposure.

This is exactly when you should NOT cash out.

Pre-Game Cash Out Example

You bet $50 on Player X to score anytime at +300 on FanDuel this morning. A few hours later, you check your bet slip and FanDuel is offering you a $65 cash out - $15 more than you wagered.

What's happening? The line has moved. Maybe it's now +220 across the market. FanDuel is holding a ticket that's now more valuable than when you placed it. They'd rather pay you $65 now than risk paying you $200 later.

The math:

Your original bet: $50 to win $150 profit (+300)

Current fair value if the line is now +220: roughly $70-75 in expected value

FanDuel's offer: $65

See the problem? They're offering you LESS than fair value. They've built vig into the cash out. You're paying the house edge twice - once when you placed the bet, and again if you cash out.

The play: If you identified +EV at +300 and the line moved to +220, you were RIGHT. The market confirmed your edge. Why would you sell that edge back to the book at a discount?

Live/In-Game Cash Out Example

This gets even more aggressive during games. Let's say you bet $20 on a role player to score 20+ points at +600 - a longshot prop. After the first quarter, he already has 12 points and is heating up. FanDuel pops up: "Cash out available: $75."

That's nearly 4x your wager! Tempting, right?

But think about what's actually happening. Your guy is on pace for 48 points. The probability he hits 20 went from ~14% (implied by +600) to maybe 85% based on live game state. Your $20 bet to win $120 profit is now almost a lock.

The real math:

If he has an 85% chance to hit 20+ now, your expected value is roughly 0.85 × $140 = $119

FanDuel is offering you $75

That's a $44 haircut - they're keeping 37% of your equity

FanDuel knows your bet is worth way more than $75. They're betting you'll take the guaranteed money and leave $44 on the table.

The psychology they're exploiting:

You see 4x your money and feel like you're "winning big"

Fear kicks in - what if he gets in foul trouble? What if they bench him in a blowout?

The cash out button is RIGHT THERE, one tap away

This is by design. Sportsbooks make significant revenue from cash outs because bettors consistently accept less than fair value.

The Vig on Cash Outs

Cash out offers typically represent a significant discount from your true equity. In the example above, you're giving up 37% of your fair value - and that's not unusual.

Let's put that in perspective: the standard vig on a -110/-110 line is about 4.5%. The vig on a cash out can be 15%, 25%, even 40% depending on the situation. You'd never place a bet with that kind of vig baked in, but that's essentially what you're doing when you cash out.

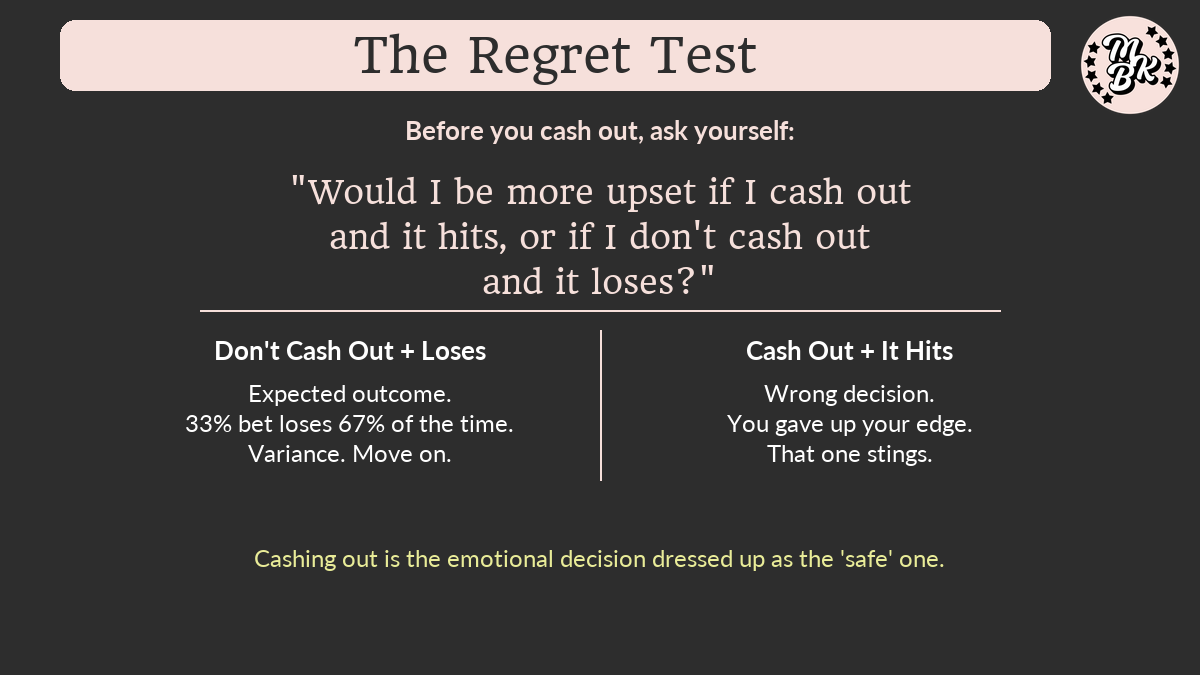

The Regret Test

When you're staring at that cash out button, ask yourself this question:

"Would I be more upset if I cash out and then the bet hits, or if I don't cash out and the bet loses?"

Really sit with that for a moment. For most people, the honest answer is: they'd regret cashing out and watching it hit far more than they'd regret letting it ride and losing.

Why? Because if you don't cash out and it loses, that was always the expected outcome for a bet with, say, a 33% chance of winning. You made the mathematically correct decision. You can live with variance.

But if you cash out and then watch your guy score the winning touchdown or hit his 5th three-pointer? That's not variance - that's you making the wrong decision and paying for it. That stings differently.

The regret test isn't about emotion overriding math - it's about recognizing that cashing out is usually the emotional decision dressed up as the "safe" one.

When You're New to Cash Out Discipline

If you've recently committed to not cashing out, expect some discomfort. Here's the thing: you're going to be hyper-aware of the ones that don't hit.

When you let a bet ride and it loses, your brain screams "SEE! Should have cashed out!" But you were already making this decision before - you just weren't paying attention. You're experiencing awareness bias, not worse luck.

What your brain conveniently forgets: all the times you would have cashed out and then it hit anyway. Those Twitter cautionary tales exist for a reason - we've all seen the screenshots of someone who cashed out a 10-leg parlay for $2,000 only to watch the last three legs hit for what would have been $180,000.

Remember: variance swings both ways. If you're in a cold stretch where your let-it-ride strategy feels painful, that's normal. The math hasn't changed. The hot streaks are coming. Stay the course.

When Cash Out MIGHT Make Sense

I'll be honest - there are rare situations where cashing out is defensible:

True life-changing money: This is the big one. If you're looking at $500,000 potential payout and the cash out is $250,000, the utility of guaranteed life-changing money might outweigh the EV loss. We're talking money that fundamentally changes your life trajectory - paying off your house, funding your kid's college, retiring early. This is deeply personal and depends entirely on your financial situation. For most normal bets, this doesn't apply.

You bet way more than you should have: If you accidentally bet your rent money and the stress is affecting your sleep, your relationships, your work - pay the vig and get out. Your mental health matters more than optimal EV. But the real lesson here is to fix your bankroll management so this doesn't happen again.

You have new information the market hasn't priced: If you learn something material after placing the bet (injury news, lineup change) that you believe the cash out hasn't fully accounted for, taking the cash out could be correct. This is rare - books usually adjust quickly.

For normal bets? Let them ride.

The key distinction: Are you cashing out because of math or because of fear? If it's fear, that's the sportsbook winning.

The Hedge Alternative

If you genuinely want to lock in profit, hedging is almost always better than cashing out.

Instead of accepting FanDuel's discounted cash out, you can bet the other side at another book. You'll typically get better odds than the implied odds in the cash out offer, meaning you keep more of your equity.

The cash out exists because it's profitable for the sportsbook. They wouldn't offer it if it weren't.

The Bottom Line on Cash Outs

A cash out offer above your wager is a signal that you made a good bet. The book is confirming you have positive CLV. They're essentially saying "we're worried about this ticket."

That's exactly when you should hold.

Every time you hit "cash out," you're:

Paying vig a second time

Surrendering edge you already earned

Bailing the book out of a bad position

+EV betting is about trusting the math and letting variance play out. Cashing out is the opposite - it's letting fear override math.

If you consistently take +EV bets and consistently cash them out early, you're sabotaging your own edge. The sportsbooks are counting on exactly that.

ROI%: Measuring Your Results

While CLV measures process, ROI% (Return on Investment) measures results. Let's break down what it means and how to interpret it.

What is ROI%?

ROI% = (Total Profit / Total Amount Wagered) × 100

It tells you what percentage return you're getting on the money you put at risk.

A Simple Example

You bet $1,000 total over a month and end up with $1,050.

ROI% = ($50 / $1,000) × 100 = 5%

You made a 5% return on the money you wagered.

What's a Good ROI%?

Here's the reality check: sustainable ROI% in sports betting is lower than most people think.

2-5% ROI: Very good. This is what many successful bettors achieve long-term.

5-10% ROI: Excellent. You're doing something right.

10%+ ROI: Exceptional (or small sample size)

If someone tells you they're running 20%+ ROI over thousands of bets, be skeptical. The edges in sports betting are thin. Sustainable double-digit ROI is extremely rare.

ROI% vs Win Rate

Many bettors focus on win rate (what percentage of bets you win). But win rate is misleading without context.

Consider:

Bettor A: 60% win rate on -110 bets = losing money

Bettor B: 35% win rate on +300 bets = making money

Win rate doesn't account for odds. ROI% does.

You can have a 30% win rate and be highly profitable if you're hitting longshots at good odds. You can have a 55% win rate and be losing if you're paying too much vig.

ROI% is the number that matters.

ROI% and Sample Size

Here's the catch: ROI% fluctuates wildly in small samples.

After 50 bets, your ROI% might be +15% or -10% based largely on luck. After 500 bets, it starts to stabilize. After 2000+ bets, it's a reliable indicator of your true edge.

Don't panic over short-term ROI%. Don't get overconfident either. Trust the process and let the sample size grow.

Yield vs ROI

You might also see the term "yield" - it means the same thing as ROI%. Some people use "yield" for betting and "ROI" for investments, but mathematically they're identical.

What ROI% to Expect from +EV Betting

If you're taking +EV opportunities from the Value Finders with proper execution:

2-5% ROI over a large sample is realistic

This compounds into significant profit over hundreds/thousands of bets

Variance will make short-term ROI swing above and below this

The goal isn't to maximize ROI% - it's to maximize total profit. Higher volume at moderate ROI% beats low volume at high ROI%.

Why I Focus on +EV (And Why You Should Too)

Here's the bottom line:

There are two ways to approach betting:

Try to pick winners (gambling)

Try to find +EV opportunities (investing)

The first approach relies on being smarter than the market consistently. Good luck with that - you're competing against algorithms, sharp syndicates, and the collective wisdom of millions of bettors.

The second approach just requires finding mispricings. You don't need to be right more often than the market. You just need to bet when the price is wrong in your favor.

That's what +EV betting is. Finding spots where the sportsbook's price is wrong, and capitalizing on it.

It's not exciting. It's not about being right. It's about the math being on your side.

And over time? The math always wins.

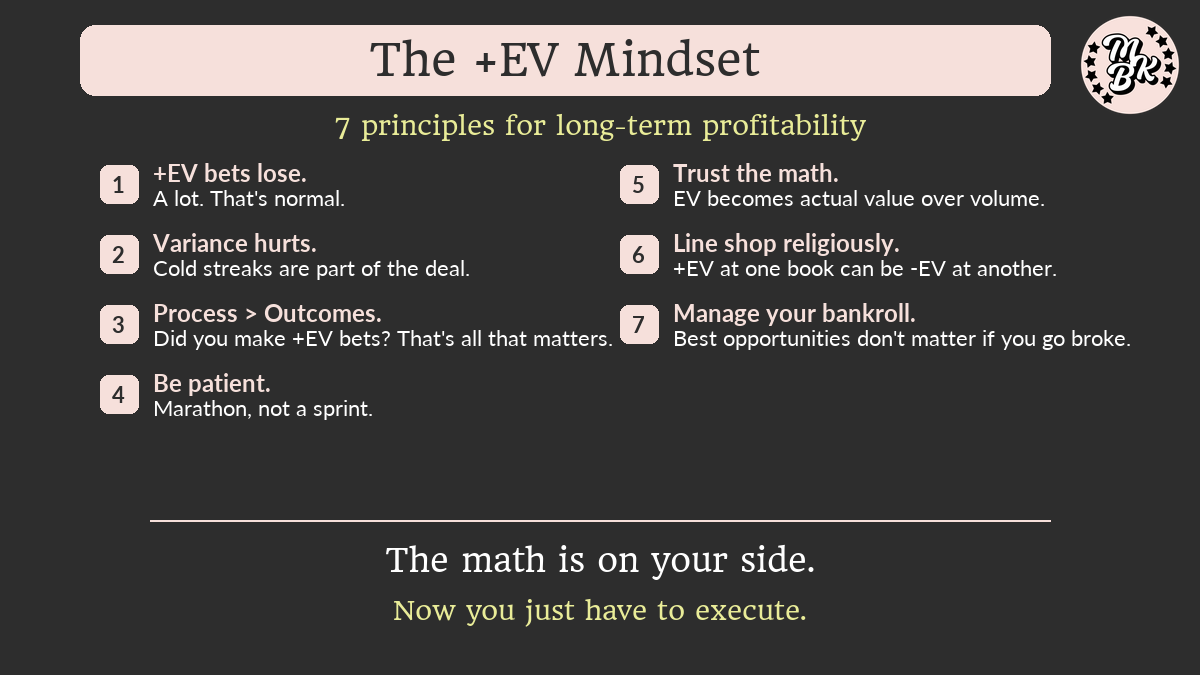

The +EV Mindset: A Summary

Accept that +EV bets lose. A lot. That's normal.

Accept that variance hurts. Cold streaks are part of the deal.

Focus on process, not outcomes. Did you make +EV bets? That's all that matters.

Be patient. +EV betting is a marathon, not a sprint.

Trust the math. Over enough volume, expected value becomes actual value.

Line shop religiously. +EV at one book can be -EV at another.

Manage your bankroll. The best +EV opportunities don't matter if you go broke first.

Start Here

If you're new to +EV betting, here's your checklist:

Set up your bankroll - Money you can afford to lose, 1 unit = 1%

Get accounts at multiple books - More books = more +EV opportunities

Use the Value Finders - Let me do the math for you

Take the best available odds - Always line shop

Track your bets - Know your numbers over time

Be patient and consistent - Trust the process

The math is on your side. Now you just have to execute.

Ready to learn more? Check out Bankroll Basics for proper money management, Why Taking the Best Odds Matters for data on line shopping, How to Use the Value Finders for finding opportunities, and [The Seven Deadly Sins of Betting - COMING SOON!] for the mistakes to avoid.

⚠️ The MKB Blog is for entertainment purposes only and is not financial advice. This is gambling, and nothing is guaranteed. Wager at your own risk & discretion. ⚠️

Ready to Level Up?

〰️

Ready to Level Up? 〰️

Getting Value Odds matters! Learn more about joining our VIP community, or join now below.

Unlock full access to the Mama Knows Bets VIP Discord and Website with an All Access VIP membership. Line shop with our Value Finders and explore all players across all our Value Models everyday (including VIP exclusive props!) with expanded data metrics. Sort, filter and export to find your next best play.